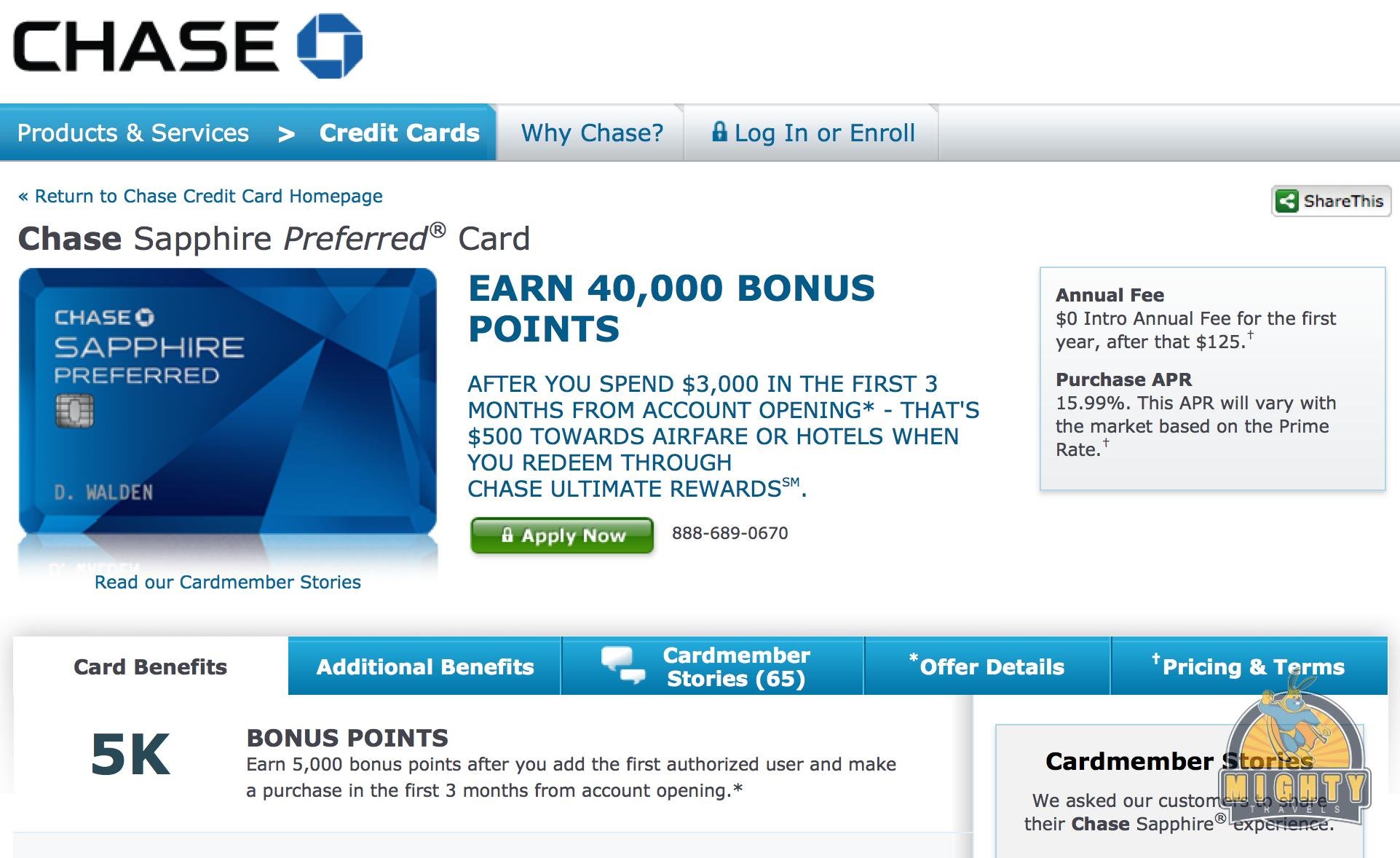

Review: Chase Sapphire credit card – earn 40,000 points when signing-up

Apply here!

The Chase Sapphire card has been one of my favorite cards since day one and is currently the main card in my wallet. Let me tell you a bit more about it.

What does Chase offer?

- Earn 40,000 Bonus Points (after $3,000 spend).

- Earn 5,000 bonus points after you add the first authorized user and make a purchase in the first 3 months from account opening

- 2x Earn 2X points on travel and dining at restaurants. 1 point per dollar spent on all other purchases.

- 7% Annual Points Dividend on all new points earned on purchases throughout the year - even points you have redeemed*.

- 1:1 Transfer points to participating frequent travel programs at full value - that means 1,000 Chase Ultimate Rewards points equal 1,000 partner miles/points. Travel programs include British Airways Executive Club, Korean Air SKYPASS, Southwest Airlines Rapid Rewards®, United MileagePlus®, Virgin Atlantic Flying Club, Amtrak Guest Rewards®, Hyatt Gold Passport®, Marriott Rewards®, IHG® Rewards Club and The Ritz-Carlton Rewards®.

- No foreign transaction fees.

Why should you get this card?

1) 45,000 sign up bonus

This is a great offer and since you earn Ultimate Rewards points you can use them on a lot of different partners. Spend $3,000 and get an authorized user for your card.

2) Access to Ultimate Rewards Shopping Mall

Ultimate Rewards are still my favorite rewards currency after the United devaluation since you can also use them with Hyatt, British Airways Avios and Korean Air for high-value redemptions. The Ultimate Rewards Mall has a good number of shopping deals available. The mall is run by Cartera but usually tracks purchases well. If not, Chase customer service is fantastic in tracking it down and crediting it manually!

3) 7% Annual Dividend is nicer than it sounds

You may think it's small but it adds up - it's always a nice surprise to see this posting!

4) Double Points on Travel and Dining

Most of my expenses are Dining and Travel expenses - so this card is what I'll be using!

5) Annual fee waived in year #1

The annual fee is reasonable to begin with ($95) and is waived in the first year.

6) No foreign transaction fees

No nasty fees for foreign purchases (many of my transactions are).

7) It's a Visa and MasterCard

The card is available as Visa and MasterCard. You can apply for both versions and get 2 sign-up bonuses! Visa/MasterCard is hands down the most accepted credit card out there.

8) Zero Liability for fraudulent charges

If you find charges that you did not make - call Chase and the issue is resolved without bureaucracy.

9) Comprehensive Insurance Package (with great customer service)

Trip Cancellation and Trip Interruption Insurance

Auto Rental Collision Damage Waiver

Travel Accident Insurance

Travel and Emergency Services

Lost Luggage Reimbursement

Trip Delay

Baggage Delay

Purchase Protection

Extended Warranty Protection

Price Protection

Return Protection

10) This card looks cool!

The effect was more pronounced 18 months ago but it still opens many cashiers eyes that you use such a 'heavy card'.

Apply here!

If you like this post - subscribe via email or follow us on Twitter.